Allocating Fringe Benefits: DCAA Best Practices for Compliance

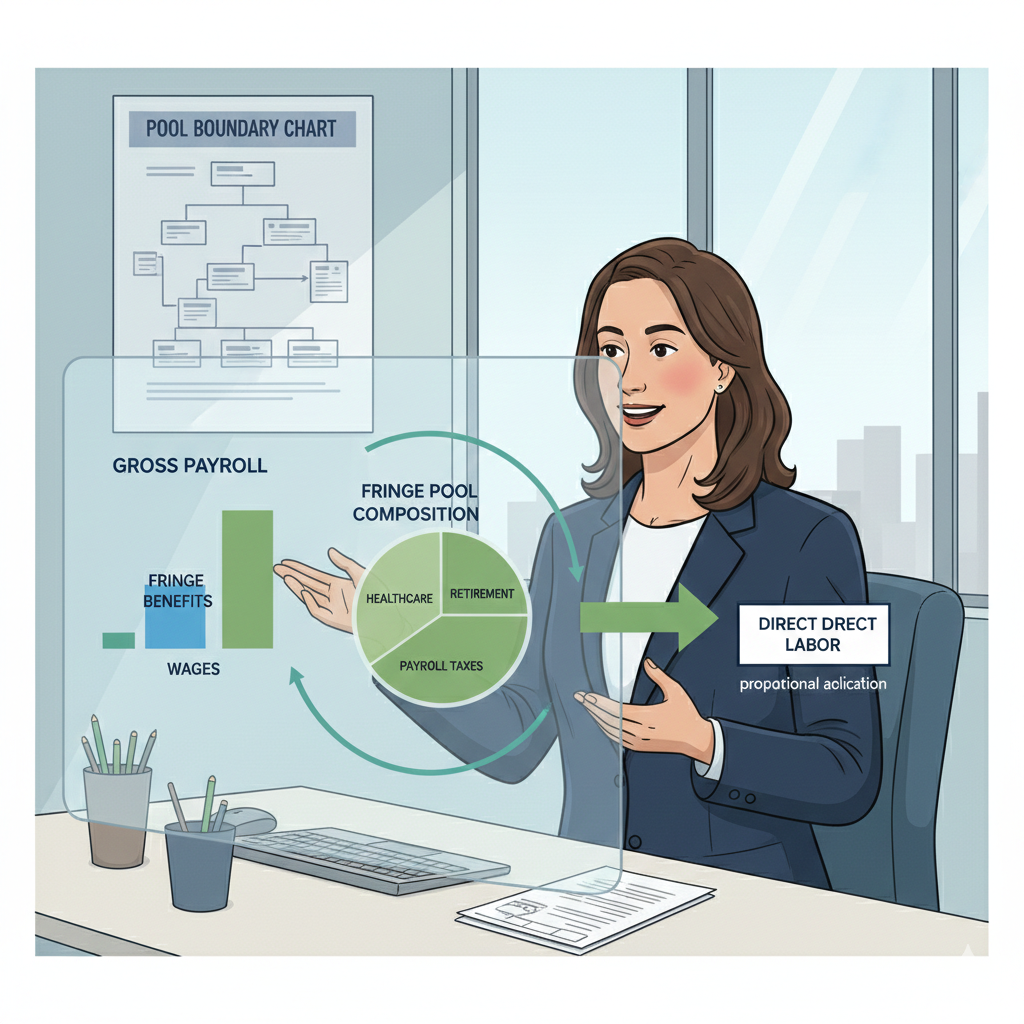

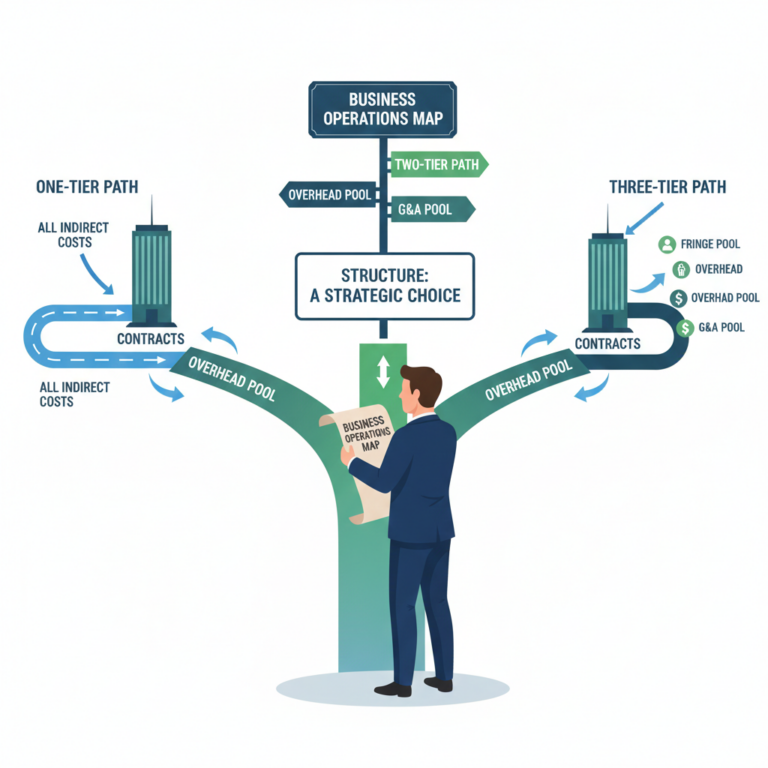

Your company calculated fringe benefit rates by dividing total fringe costs by total payroll including both direct and indirect labor, then applied those rates to direct labor only when charging contracts—effectively allocating indirect employee fringe costs to direct contracts while excluding them from overhead calculations. During your incurred cost audit, DCAA discovered this inconsistency and questioned $285,000 in contract costs, citing improper fringe allocation methodology creating double recovery where direct contracts absorbed fringe for indirect employees without offsetting overhead reductions. Here’s what contractors miss about fringe benefit allocation: the base you use to calculate fringe rates must match the base you apply rates to when charging contracts, and costs included in fringe pools cannot simultaneously appear in overhead pools—violations of these fundamental principles create the allocation errors, double-counting problems, and rate calculation mistakes that transform compliant payroll practices into systematic cost accounting deficiencies invalidating your entire indirect rate structure. Understanding how to properly allocate fringe benefits isn’t about complex actuarial calculations—it’s about maintaining consistent allocation base definitions, preventing double-counting through clear pool boundaries, ensuring rate calculations align with rate applications, and documenting methodologies proving fringe allocation produces equitable cost distribution supporting both direct contract charging and indirect rate calculations.

The Legal Framework Governing Fringe Benefit Allocation

Federal cost accounting standards establish specific requirements ensuring fringe benefit costs allocate equitably to cost objectives without double-counting or inconsistent treatment. FAR 31.201-4 requires costs to be allocable based on relative benefits received or other equitable relationships, meaning fringe benefits must allocate to employees receiving benefits through methodologies reflecting actual cost relationships. When all employees receive substantially similar benefits, allocation using payroll bases produces equitable distribution. When benefit levels vary significantly by employee category, more sophisticated allocation methodologies might be necessary ensuring costs align with actual benefits provided.

The consistency requirements under Cost Accounting Standard 412 govern composition and measurement of pension costs, establishing principles applicable to all fringe benefits regarding consistent cost measurement and allocation period treatment. CAS 412 principles emphasize that benefit costs must be measured consistently, allocated using appropriate bases reflecting benefit provision, and treated uniformly across cost objectives preventing discriminatory allocation favoring certain contracts or customers over others. Understanding DCAA compliance requirements means recognizing that fringe allocation demands the same rigor as other indirect costs despite payroll processing systems often handling fringe separately from other cost accounting functions.

Cost Accounting Standard 418 governs allocation of direct and indirect costs, requiring contractors to maintain clear boundaries between cost pools and preventing the same costs from appearing in multiple pools or the same allocation bases from being used inappropriately. For fringe benefits, this means costs included in fringe pools must exclude from overhead or G&A pools, and allocation bases used for fringe rate calculations must align with bases receiving rate applications. When fringe pool definitions overlap with overhead pools or when rate calculation bases differ from application bases, you’ve created the CAS 418 violations that DCAA identifies through systematic rate calculation verification and pool composition analysis.

The critical consideration involves FAR 31.205-6(m), governing compensation allowability including fringe benefits such as employer contributions to health insurance, retirement plans, life insurance, unemployment insurance, workers’ compensation, and payroll taxes. This provision establishes allowability criteria fringe costs must satisfy including reasonableness compared to benefits provided by other employers in similar circumstances, consistency with contractor’s established practices, and compliance with applicable laws and agreements. Fringe allocation methodology doesn’t affect allowability determinations, but improper allocation of otherwise allowable costs creates questioned costs through allocation deficiencies even when underlying fringe costs fully comply with allowability standards.

What Contractors Must Understand About Fringe Benefit Allocation Challenges

Here’s what contractors miss about fringe allocation: payroll service providers calculating fringe costs for tax compliance purposes don’t necessarily produce cost accounting compliant allocation methodologies—you need allocation approaches satisfying both payroll tax requirements and government contract cost accounting standards, with the two frameworks addressing different compliance obligations through potentially different methodologies. DCAA compliance explained emphasizes that contractors must take ownership of cost accounting methodology regardless of whether external payroll providers handle payroll processing, ensuring vendor calculations align with cost accounting requirements rather than assuming payroll compliance guarantees cost accounting adequacy.

The allocation base mismatch problem emerges when contractors calculate fringe rates using one base but apply rates using different base, creating mathematical inconsistency producing inaccurate cost allocation. This is where audits go sideways—you calculate fringe rate as total fringe costs divided by total gross payroll (including both direct and indirect labor), producing 28% rate. Then you apply this 28% only to direct labor when charging contracts, excluding indirect labor from rate application despite including indirect payroll in rate calculation. This mismatch means you’ve allocated indirect employee fringe costs to direct contracts without corresponding allocation to indirect pools, creating the cost allocation error that DCAA flags as fundamental methodology deficiency requiring correction and potential cost recovery from overcharged contracts.

The double-counting vulnerability surfaces when fringe costs appear in both dedicated fringe pools and overhead or G&A pools, creating duplicate allocation charging contracts twice for same costs through different indirect rate mechanisms. Your healthcare premiums might post to fringe benefit accounts included in fringe pool calculations while also flowing through overhead pool as indirect costs when fringe isn’t segregated in separate pool. When both fringe rates and overhead rates allocate the same healthcare costs, you’ve created double-counting violation that CAS 418 specifically prohibits. Clear pool definitions with documented boundaries preventing overlap eliminate this risk while demonstrating cost accounting discipline that DCAA expects.

The composite rate versus separate rate decision creates allocation methodology choices with compliance implications. Composite fringe rates combine all fringe costs (healthcare, retirement, payroll taxes, workers’ comp, etc.) in single pool allocated using single rate, while separate rates maintain distinct pools for different benefit types each with own allocation methodology. DCAA timekeeping requirements extend to supporting whichever fringe allocation methodology you select, with labor distribution accuracy supporting allocation base calculations regardless of rate structure complexity. Composite approaches offer administrative simplicity but might produce less precise allocation when different benefit types have materially different cost drivers, while separate rates enable precision at increased administrative cost.

The employee category differentiation challenge emerges when fringe costs vary significantly by employee type—executives receiving richer benefits than hourly workers, union employees with negotiated benefit packages different from non-union staff, or full-time employees receiving benefits that part-time employees don’t. When benefit costs per employee vary materially across categories, single blended fringe rate allocated uniformly might produce inequitable allocation compared to category-specific rates reflecting actual cost differences. However, establishing multiple fringe pools by employee category increases administrative complexity and requires detailed payroll tracking supporting category-specific rate calculations and applications.

The timing and accrual considerations affect fringe allocation when benefit costs incur on different schedules than corresponding payroll—healthcare premiums paid monthly, retirement contributions remitted quarterly, vacation accruals building throughout year but paid when taken. Proper accrual accounting ensures fringe costs allocate to periods when corresponding labor occurs rather than when fringe payments process, maintaining matching between labor charges and associated fringe costs. Without proper accruals, timing mismatches create rate fluctuations and period-to-period allocation distortions that more sophisticated accounting would prevent.

The unallowable fringe cost treatment requires identifying and excluding fringe costs that FAR prohibits such as excess executive compensation, certain bonuses exceeding reasonable levels, or benefits lacking business purpose. These unallowable amounts must segregate from fringe pools before rate calculations, preventing their allocation to government contracts through fringe rates even though they appear in payroll processing and represent actual cash expenditures. Systematic unallowable cost identification within fringe categories prevents the questioned costs resulting when DCAA discovers prohibited expenses hidden within otherwise allowable fringe pool totals.

Five Essential Steps for Compliant Fringe Benefit Allocation

Step 1: Establish Clear Fringe Pool Definitions with Documented Boundaries

Develop comprehensive documentation defining fringe benefit pool composition including specific cost types included (healthcare, dental, vision, life insurance, disability, retirement contributions, FICA, FUTA, SUTA, workers’ compensation), excluded cost types that belong in other pools or represent unallowable costs, and boundary definitions preventing overlap with overhead or G&A pools. Written pool definitions provide operational guidance for cost classification while supporting audit defense demonstrating systematic approach to pool composition rather than arbitrary or inconsistent cost treatment.

Create general ledger account structure with dedicated accounts for each fringe cost type, enabling clear identification of costs included in fringe pools and preventing the chart of accounts ambiguity that creates classification confusion. When healthcare costs post to clearly identified fringe benefit accounts separate from overhead accounts, cost classification becomes systematic accounting function rather than subjective judgment requiring analysis. Account structure clarity supports both accurate pool composition and efficient audit verification.

Implement cost classification procedures requiring accounts payable and payroll staff to properly code fringe costs to correct accounts based on documented pool definitions, with management review ensuring classification accuracy and consistency. These procedures prevent the gradual pool composition drift that occurs when individual transactions get coded inconsistently over time, creating the pool boundary violations that audits discover through detailed cost testing.

Step 2: Design Allocation Base Methodology Ensuring Calculation-Application Consistency

Develop fringe allocation base methodology ensuring bases used for rate calculations match bases receiving rate applications when charging contracts and indirect pools. If calculating fringe rates using direct labor dollars in numerator, ensure rate applications charge fringe only to direct labor excluding indirect labor. If calculating rates using total payroll including both direct and indirect labor, ensure applications allocate fringe to both direct and indirect activities proportionally. This calculation-application consistency represents fundamental requirement preventing the allocation errors that base mismatches create.

Document allocation base definitions with precision explaining exactly what payroll elements include in bases—base wages only, or base plus overtime premium, or total cash compensation including bonuses. Define whether contractor contributions to deferred compensation, stock plans, or other programs belong in allocation bases or receive separate treatment. Detailed base definitions prevent the ambiguity creating inconsistent calculations across periods or between rate calculation and application processes.

Implement allocation base tracking procedures ensuring accurate measurement of bases used for fringe rate calculations and applications. This requires integrated timekeeping and payroll systems providing reliable direct versus indirect labor cost data, detailed job costing capturing direct labor by contract, and accounting processes generating total payroll summaries supporting rate calculations. Base tracking accuracy determines allocation reliability, with measurement errors undermining even well-designed allocation methodologies through unreliable base data.

Step 3: Calculate Fringe Rates Using Appropriate Methodologies and Frequencies

Establish fringe rate calculation procedures determining calculation frequency (monthly, quarterly, annually), rate types (actual rates, budgeted rates, provisional rates), and calculation methodologies (simple division of costs by bases, accrual-adjusted calculations, forward-looking projections). Most contractors calculate actual monthly or quarterly fringe rates by dividing period fringe costs by period payroll bases, providing current rates for contract charging while enabling periodic rate updates reflecting actual cost experience.

Develop rate calculation documentation showing all computation elements including numerator components (specific fringe costs), denominator components (allocation base definition and amount), calculation period, and resulting rate. Comprehensive calculation workpapers support both management review ensuring rate reasonableness and audit verification enabling DCAA to validate rate calculations without extensive additional information requests. Documentation quality demonstrates professional cost accounting practices that auditors recognize as compliance indicators.

Implement rate reasonableness review comparing calculated rates to prior periods, industry benchmarks, and budgeted expectations, investigating unusual variances requiring explanation or correction before rate application. Systematic review catches calculation errors, data processing problems, or unusual cost patterns requiring management attention, preventing the application of clearly erroneous rates that mathematical errors or system failures might produce without reasonableness validation.

Step 4: Prevent Double-Counting Through Systematic Pool Boundary Management

Conduct comprehensive cost flow analysis verifying that all fringe costs appear in only one indirect pool—either fringe pool or overhead pool or G&A pool—but never in multiple pools creating double allocation. Create cost flow diagrams showing how payroll costs segregate between gross wages posted to direct/indirect labor accounts and fringe costs posted to fringe pool accounts, demonstrating clear boundaries preventing overlap. This visual documentation helps both internal staff and auditors understand pool relationships while revealing any boundary violations requiring correction.

Implement fringe-to-overhead reconciliation procedures verifying that costs included in fringe pools exclude from overhead pools, with periodic cross-checks ensuring no cost categories inadvertently appear in both locations. When establishing or modifying pools, systematic verification prevents the double-counting that structural changes might introduce through inadequate boundary definition or account mapping errors.

Deploy validation controls flagging cost classifications that violate pool boundary rules, such as account coding that would place same expense in both fringe and overhead pools. Automated controls prevent boundary violations at transaction level rather than discovering problems through periodic reconciliation after improper classifications already affected rate calculations and contract charging. Prevention-focused controls reduce correction burden while improving allocation reliability.

Step 5: Maintain Comprehensive Documentation Supporting Allocation Methodology

Develop written fringe allocation methodology documentation explaining pool composition, allocation base definition, rate calculation procedures, rate application methods, frequency of rate updates, and controls preventing double-counting or inconsistent treatment. This methodology description provides both operational guidance and audit support, enabling personnel turnover without methodology knowledge loss while facilitating efficient DCAA verification understanding your approach without extensive questioning.

Create allocation base supporting schedules documenting payroll amounts used for rate calculations with clear tie-in to general ledger accounts, payroll registers, and labor distribution reports. These schedules demonstrate allocation base accuracy while enabling auditors to verify base calculations traced properly to underlying source records. Supporting documentation quality determines audit efficiency, with well-organized schedules enabling rapid verification while incomplete documentation necessitates extensive additional requests prolonging audits.

Implement periodic methodology review evaluating whether current fringe allocation approach continues producing equitable results or whether business changes require methodology modifications. When employee mix shifts substantially, benefit programs change materially, or operational characteristics evolve, fringe allocation methodology might require refinement ensuring continued equity and compliance. Systematic review demonstrates cost accounting stewardship while preventing the methodology obsolescence that occurs when contractors maintain legacy approaches despite changed circumstances requiring updated treatment.

The Investment in Compliant Fringe Benefit Allocation

Implementing compliant fringe benefit allocation methodology costs between $8,000 and $25,000 for small to mid-sized contractors including methodology design, documentation development, system configuration, and training. Annual maintenance costs typically run $3,000 to $8,000 for ongoing rate calculations, methodology monitoring, and documentation updates. These investments ensure fringe costs allocate properly supporting both contract pricing accuracy and cost recovery compliance.

Let me show you the value: contractors with proper fringe allocation maintain cost accounting system adequacy through equitable fringe treatment, avoid questioned costs from allocation methodology deficiencies or double-counting violations, and gain rate calculation accuracy supporting reliable contract pricing and profitability analysis. They demonstrate professional cost accounting practices that DCAA recognizes through efficient audits and minimal findings.

Contractors with improper fringe allocation face substantial questioned costs when DCAA discovers allocation base mismatches or double-counting creating systematic overcharges, experience accounting system disapproval requiring corrective action before contract awards, and make poor pricing decisions based on inaccurate fringe rates distorting true labor costs. They discover that fringe allocation errors affect every contract through distorted indirect rates, multiplying impact beyond individual questioned transactions.

Understanding Fringe Allocation Requirements Across Contract Types

Fringe benefit allocation requirements apply uniformly to cost-reimbursement contracts where proper fringe treatment directly affects reimbursable costs and to time-and-materials contracts where loaded labor rates must include appropriate fringe allocations. Fixed-price contracts require accurate fringe rates for proposal development and contract modifications even though allocation methodology doesn’t affect payment amounts. Your fringe methodology must satisfy requirements across all contract types, with comprehensive approach serving entire portfolio.

FAR cost principles and CAS standards governing fringe allocation apply consistently across Department of Defense, NASA, Department of Energy, and civilian agency contracts, meaning allocation methodology remains uniform regardless of customer agency. CAS 412 applicability depends on contract size and pension plan existence, but allocation principles apply broadly establishing best practices even for non-CAS contractors.

Your Path to Fringe Allocation Excellence

The fringe benefit allocation landscape rewards contractors who invest in systematic methodology design, clear pool definitions, and comprehensive documentation rather than treating fringe as payroll department responsibility separate from cost accounting oversight. DCAA evaluates fringe allocation through rate calculation verification and pool composition testing, with adequacy depending on methodology consistency and documentation quality rather than allocation complexity.

For contractors seeking fringe allocation compliance, Hour Timesheet provides labor tracking supporting accurate allocation base calculations through reliable direct versus indirect labor segregation and detailed payroll data supporting whichever fringe methodology your analysis determines appropriate. Our systems provide the labor distribution accuracy that fringe allocation requires.

Your fringe costs deserve allocation methodology producing equitable distribution while preventing double-counting and supporting audit verification. Implement systematic approaches ensuring compliance and cost recovery accuracy.