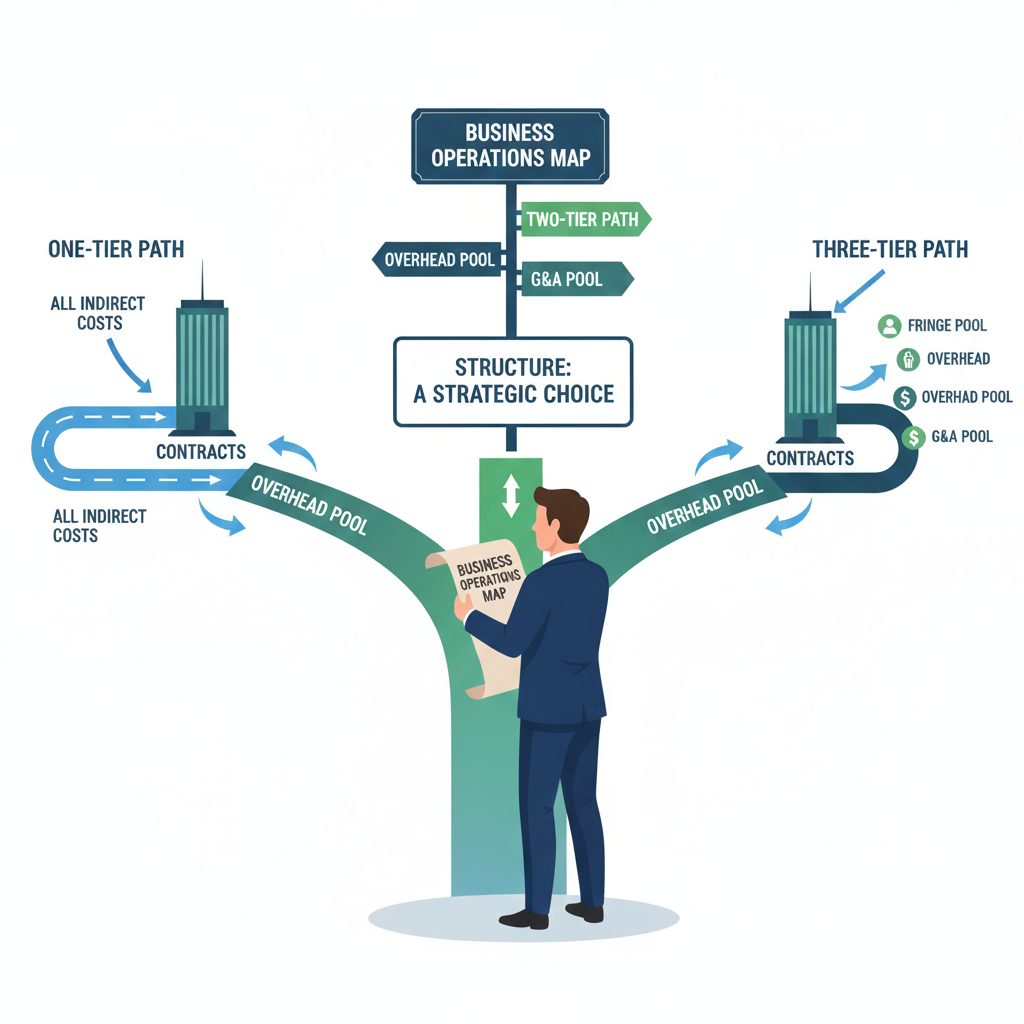

Indirect Rate Structure Design: One, Two, or Three-Tier Pools

Your company operated with a single overhead rate pooling all indirect costs—engineering support, facilities, administrative staff, and executive management—and allocating them to contracts using total direct labor as the base. During your DCAA audit, investigators discovered that your manufacturing operations consumed substantially more facility and equipment resources than your professional services work, yet both received identical overhead allocation despite dramatically different resource consumption patterns. DCAA questioned $340,000 in contract costs, arguing that your single-rate structure failed to allocate costs based on causal or beneficial relationships as regulations require, with manufacturing contracts undercharged and services contracts overcharged creating systematic cost misallocation. Here’s what contractors miss about indirect rate structure: selecting between one-tier, two-tier, or three-tier pooling arrangements isn’t arbitrary preference—it’s a compliance decision requiring analysis of your cost structure, business operations, and whether different cost types or business segments consume resources differently enough that pooling them together produces inequitable allocation compared to separate treatment. Understanding how to design, justify, and implement appropriate indirect rate structures isn’t about complexity for its own sake—it’s about ensuring cost allocation methodologies reflect actual causal or beneficial relationships between costs incurred and work performed, producing equitable distribution that satisfies regulatory standards while supporting competitive pricing and operational transparency.

The Legal Framework Governing Indirect Rate Structure Selection

Federal cost principles establish specific requirements for indirect cost allocation ensuring equitable distribution based on causal or beneficial relationships. FAR 31.203(b) requires indirect costs to be accumulated in logical cost groupings, with separate groupings for different categories of costs where allocation on combined basis would fail to allocate costs equitably among cost objectives. This provision mandates that contractors analyze whether different indirect cost types have different causal relationships with direct activities, requiring separate pooling when combined treatment would produce inequitable allocation even if separate pools create administrative complexity.

The allocation base selection criteria under FAR 31.203(d) specify that allocation bases must reflect causal or beneficial relationships between costs accumulated in pools and work receiving allocations. This means overhead costs driven by labor hours require labor-hour bases, while costs driven by material volume need material-dollar bases, and costs benefiting all operations equally can use modified total cost bases. Understanding DCAA compliance requirements means recognizing that rate structure adequacy depends on whether allocation methodologies produce equitable results reflecting actual resource consumption rather than convenient mathematical simplicity through excessive pooling.

Cost Accounting Standard 418 governs allocation of direct and indirect costs to final cost objectives, requiring contractors to establish indirect cost pools representing costs of activities with similar beneficial or causal relationships to cost objectives. CAS 418 specifically addresses when contractors must establish separate indirect pools rather than combining costs in single pools, with key criterion being whether cost types have materially different allocation patterns requiring segregation for equitable distribution. When your administrative costs benefit all activities equally while facility costs correlate with production volume, CAS 418 requires separate pools with different allocation bases rather than combined overhead pool using single base regardless of cost type diversity.

The critical consideration involves FAR 31.203(e), prohibiting double counting by preventing same costs from appearing in multiple indirect pools or preventing same allocation bases from being charged in multiple pools and also included in other pool allocation bases. This complexity increases with multi-tier structures, requiring careful pool definition ensuring costs allocate once and allocation bases used without inappropriate overlap. Rate structure design must balance equitable allocation benefits against administrative complexity and double-counting risks that elaborate structures introduce.

What Contractors Must Understand About Indirect Rate Structure Challenges

Here’s what contractors miss about rate structure design: defaulting to single overhead and G&A rates because “we’re a small company and want to keep things simple” might create the inequitable allocation that regulations prohibit regardless of administrative convenience. DCAA compliance explained emphasizes that structure selection requires analysis of cost behavior and resource consumption patterns, not contractor size or preference for simplicity. Your fifty-person company might need three-tier structure if operations include distinct segments with materially different cost drivers, while two-hundred-person company with homogeneous operations might properly use single-tier structure.

The homogeneity assumption problem emerges when contractors combine materially different cost types in single pools assuming all indirect costs have similar relationships to direct activities. This is where audits go sideways—your overhead pool might include both engineering support staff whose costs vary with direct labor hours and facility costs that correlate with production volume or square footage. When these dissimilar costs combine in single pool allocated using direct labor base, engineering-intensive service contracts receive excessive facility cost allocations while production-intensive manufacturing contracts receive insufficient allocations, creating systematic inequity that separate pools with appropriate bases would prevent. DCAA evaluates whether combined pooling produces materially different allocations than separate treatment, with material differences indicating inadequate structure requiring correction.

The business segment distinction challenge surfaces when contractors operate multiple business lines serving different markets, using different resources, or requiring different support infrastructures but pool all costs together as if operations were homogeneous. Your company might include both government services division with professional staff working in customer facilities and commercial manufacturing division with production workers, equipment, and facilities. Combining these segments’ indirect costs and allocating using blended rate creates cross-subsidization where services contracts absorb manufacturing facility costs while manufacturing work avoids appropriate facility cost allocation. Separate business segment structures—even creating distinct business units with separate rate calculations—might be necessary for equitable allocation when operations differ substantially.

The allocation base mismatch appears when contractors use convenient but causally weak allocation bases for combined indirect pools. Total direct labor dollars represents convenient base correlating with overall business volume, but might fail to reflect actual causal relationships between costs and activities. DCAA timekeeping requirements extend beyond time recording to support allocation base calculations, with direct labor hours, machine hours, material dollars, or modified total cost potentially providing better causal relationships than default total labor approaches depending on cost type and business operations. Single-tier structures using weak allocation bases might produce less equitable allocation than multi-tier structures enabling base selection matching pool characteristics.

The G&A versus overhead distinction confusion creates structure problems when contractors misunderstand the conceptual difference between these pool types. Overhead typically includes costs related to direct production or service delivery activities—production supervision, facilities directly supporting contract work, indirect labor supporting direct activities. G&A encompasses costs of overall business operations—executive management, accounting, human resources, business development. The key distinction involves whether costs relate to contract performance (overhead) or general business operations (G&A). Misclassifying costs between pools or failing to establish separate pools when cost characteristics differ materially creates allocation inequity requiring structure refinement.

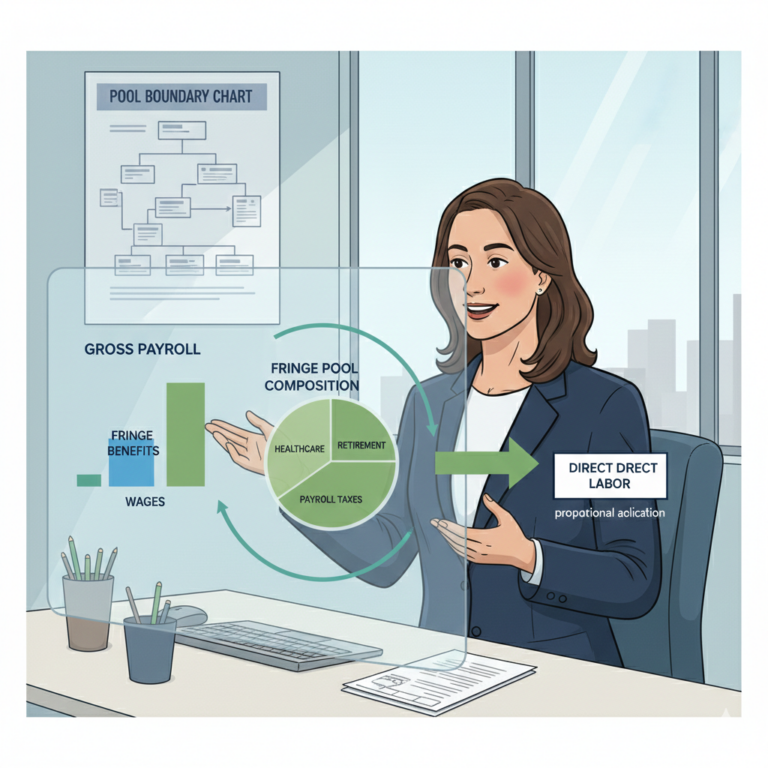

The fringe benefit treatment challenge emerges when contractors decide whether fringe benefits (healthcare, retirement, payroll taxes) should constitute separate pool or incorporate into overhead. Separate fringe pools allocated using direct labor dollars or hours provide precise allocation when fringe rates vary by employee or when fringe costs don’t correlate with other overhead expenses. Combined treatment simplifies administration but might produce less precise allocation, particularly when employee mix differs substantially across contracts or when fringe benefit costs represent material proportion of total indirect costs warranting separate treatment for visibility and control.

Five Essential Steps for Appropriate Indirect Rate Structure Design

Step 1: Conduct Comprehensive Cost Structure Analysis

Perform systematic analysis of indirect cost composition identifying major cost categories, examining whether different categories have different causal relationships with direct activities, and evaluating whether combined pooling would produce materially different allocations than separate treatment. Create detailed cost listings showing indirect expenses grouped by type (labor-related, facility-related, equipment-related, administrative), analyzing whether groups exhibit similar or different behavior patterns relative to potential allocation bases.

Analyze business operations identifying distinct segments, functions, or locations that might warrant separate rate structures based on materially different resource consumption patterns. When manufacturing operations use expensive facilities and equipment while service operations require minimal physical infrastructure, evaluate whether combined overhead pool produces equitable allocation or whether separate treatment better reflects actual cost relationships. Consider whether customers, contract types, or delivery methods differ sufficiently that pooling all costs together obscures meaningful cost variation requiring separate visibility.

Evaluate historical allocation patterns examining whether current rate structure produces stable, predictable allocations or generates significant fluctuations suggesting structural inadequacy. When overhead rates vary dramatically period-to-period despite relatively stable operations, rate structure might inadequately capture cost behavior requiring redesign separating fixed and variable components or distinguishing between cost types with different drivers. Stability analysis identifies whether structure properly reflects business economics or requires refinement improving alignment between costs and allocation bases.

Step 2: Design Pool Structure Reflecting Causal Relationships

Develop indirect pool structure segregating costs with materially different causal or beneficial relationships to cost objectives. For typical contractors, this might include: fringe benefit pool allocated using direct labor dollars, overhead pool covering production or service delivery costs allocated using direct labor hours, and G&A pool encompassing general business costs allocated using modified total cost. Each pool should contain costs with similar relationships to selected allocation base, with dissimilar costs segregated into separate pools enabling more precise allocation.

Define clear pool definitions documenting which cost types belong in each pool, what allocation base distributes each pool, and how pool definitions prevent double-counting or inappropriate overlap. Written definitions provide operational guidance for cost classification while supporting audit defense when DCAA evaluates structure appropriateness. Include rationale explaining why selected structure produces more equitable allocation than alternatives, demonstrating deliberate design rather than arbitrary convention or unexamined tradition.

Consider advanced structures when analysis reveals need including: multiple overhead pools for distinct production functions or business segments, separate material handling or subcontract costs pools when material/subcontract volume doesn’t correlate with labor, or facilities capital cost of money pools when contract requirements mandate FCCM calculation. Structure sophistication should match business complexity, with simpler structures appropriate for homogeneous operations and complex structures necessary only when meaningful cost behavior differences exist warranting separate treatment.

Step 3: Select Appropriate Allocation Bases with Documented Justification

Choose allocation bases for each indirect pool that best reflect causal or beneficial relationships between pool costs and cost objectives receiving allocation. For labor-related costs, direct labor hours or dollars typically provide strong causal relationships. For facility costs, considerations might include square footage occupied, machine hours, or production units. For general business costs, modified total cost (direct costs plus allocated overhead excluding G&A) often provides reasonable proxy for overall activity levels benefiting from G&A support.

Document base selection rationale explaining why chosen bases represent appropriate measures of benefit or causal relationship, comparing alternative bases considered, and demonstrating selected approaches produce more equitable allocation than alternatives. This documentation supports audit defense while ensuring future structure reviews consider same analytical factors rather than making changes arbitrarily. Include analysis showing allocation base availability and reliability—bases depending on data not systematically captured in accounting systems create practical problems requiring either system enhancement or alternative base selection.

Implement allocation base tracking and validation ensuring accurate measurement of bases used for rate calculations. Direct labor hours require reliable timekeeping capturing all direct labor including overtime. Material dollars need purchase orders and subcontracts properly coded to contracts. Modified total cost demands accurate job costing accumulating all direct costs by contract. Base accuracy determines rate calculation reliability, with inadequate base data undermining even well-designed pool structures through unreliable allocation base measurements.

Step 4: Maintain Consistency with CAS Requirements and Disclosed Practices

Ensure rate structure complies with Cost Accounting Standards requirements including CAS 402 (consistent allocation), CAS 403 (allocation of home office costs), CAS 410 (allocation of G&A), and CAS 418 (allocation of direct and indirect costs). For CAS-covered contractors, rate structure must align with disclosed accounting practices documented in CAS Disclosure Statements, with structure changes requiring Disclosure Statement revisions and potential cost impact analysis. Even for non-CAS contractors, CAS principles provide best practice guidance for equitable allocation structure supporting compliance and operational excellence.

Implement structure consistently across all contracts and cost objectives, avoiding differential treatment based on contract type, customer agency, or profitability considerations. When manufacturing and service contracts receive different allocation treatment, differences must reflect actual resource consumption variation rather than arbitrary classification enabling favorable pricing on competitive contracts at expense of less price-sensitive work. Allocation methodology consistency prevents the discriminatory practices that CAS prohibits while ensuring all customers receive fair treatment based on actual costs.

Document rate structure implementation including policies governing cost classification to pools, procedures for allocation base calculation, and methodologies for rate computation. Comprehensive documentation ensures consistent application across accounting personnel and time periods while supporting audit verification and management understanding of cost behavior. Documentation should explain both technical mechanics and business rationale, enabling both accountants and operational management to understand structure operation and implications.

Step 5: Conduct Periodic Structure Review and Equitability Analysis

Perform annual rate structure reviews evaluating whether current design continues producing equitable allocation or whether business evolution requires structural modifications. Analyze whether new operations, changed business mix, or revised strategies have created cost behavior patterns materially different from assumptions underlying current structure. Review competitive dynamics evaluating whether rate structure produces pricing supporting business objectives while maintaining cost accounting integrity and compliance.

Conduct periodic equitability analysis comparing current structure allocation results to alternative structures, determining whether alternatives would produce materially different contract cost allocations suggesting current structure inadequacy. When alternative structures would shift significant costs between contracts or change relative pricing substantially, evaluate whether changes reflect improved equity warranting structure modification or whether current approach remains appropriate despite alternatives producing different results. Document analysis supporting structure retention or modification decisions.

Implement proactive change management for structure modifications including: advance notification to customers when rate changes affect contract pricing, Disclosure Statement revisions for CAS-covered contractors, historical cost impact analysis determining whether changes constitute accounting changes requiring contract adjustments, and system modifications supporting new pool definitions or allocation bases. Systematic change management prevents the disruption that reactive structure modifications create while ensuring changes achieve intended equitability improvements without unintended consequences.

The Investment in Appropriate Rate Structure Design

Implementing optimal indirect rate structure costs between $12,000 and $40,000 for small to mid-sized contractors depending on analysis complexity, structure sophistication, and system modifications required. This includes cost analysis, structure design, documentation development, system configuration, and training. Ongoing maintenance costs typically run $4,000 to $12,000 annually for structure monitoring, equitability analysis, and updates addressing business changes.

Let me show you the value: contractors with appropriate rate structures produce equitable cost allocation supporting defensible pricing, efficient DCAA audits with minimal questioned costs from allocation methodology challenges, and competitive advantages through pricing transparency demonstrating costs align with value delivered. They avoid the substantial cost reallocations that result when DCAA requires structure changes during audits, forcing retroactive contract cost adjustments and customer disputes.

Contractors with inappropriate rate structures face questioned costs when DCAA determines allocation methodologies produce inequitable results, experience pricing disadvantages when unsophisticated structures prevent understanding true costs of different work types, and risk business disputes when customers question whether cost allocations fairly reflect resource consumption. They discover that administrative simplicity achieved through inadequate pooling costs more than proper structure implementation.

Understanding Rate Structure Requirements Across Agencies

FAR cost principles and CAS requirements apply uniformly across federal agencies including Department of Defense, NASA, Department of Energy, and civilian agencies, meaning rate structure standards remain consistent regardless of customer. Cost-reimbursement contracts depend directly on accurate indirect rates while fixed-price contracts require reliable rates for proposal pricing and contract modifications. Your structure must satisfy requirements for all contract types you perform, with comprehensive approach serving diverse portfolio needs.

CAS coverage depends on contract dollar thresholds and contractor size, with large contractors meeting coverage criteria subject to full CAS requirements including Disclosure Statement obligations. Small contractors typically avoid full CAS coverage but remain subject to modified CAS requirements and FAR cost principles establishing similar equitable allocation standards. Understanding your CAS status determines specific compliance obligations while recognizing that equitable allocation remains fundamental requirement regardless of formal CAS coverage.

Your Path to Rate Structure Excellence

The indirect rate structure landscape rewards contractors who invest in analytical structure design producing equitable allocation rather than defaulting to conventional approaches or maintaining legacy structures through inertia. DCAA evaluates rate structure appropriateness through equitability analysis comparing current methodology to potential alternatives, with adequacy depending on whether structures reflect business economics and cost behavior rather than administrative convenience.

For contractors seeking rate structure compliance, Hour Timesheet provides labor tracking supporting various allocation base calculations including direct labor hours, direct labor dollars, and detailed project charging enabling modified total cost determinations. Our systems provide allocation base accuracy supporting whatever structure design your analysis determines appropriate for equitable cost distribution.

Your indirect costs deserve allocation methodology reflecting actual causal relationships and resource consumption. Invest in structure design ensuring equity, compliance, and operational insight supporting business success.