Executive Compensation Caps: Calculating the DCAA Ceiling

Your company paid your CEO $875,000 in total compensation and charged the full amount to indirect pools allocating across all contracts including government work. During your incurred cost audit, DCAA applied the executive compensation benchmark limitation—currently $487,000 for the relevant year—and questioned $388,000 in excess compensation plus the associated fringe benefits and overhead allocation, totaling $520,000 in unallowable costs improperly charged to government contracts. Here’s what contractors miss about executive compensation caps: federal cost principles limit how much executive and highly-compensated employee pay can be charged to government contracts regardless of market rates, business performance, or what you actually paid—you must identify compensation exceeding regulatory caps, exclude excess amounts from indirect pools before calculating rates, and maintain detailed supporting documentation proving cap calculations and excess cost exclusions occurred properly. Understanding how to calculate, apply, and document executive compensation limitations isn’t about restricting pay decisions—it’s about ensuring the government only reimburses compensation up to established benchmarks, preventing taxpayers from subsidizing executive pay packages exceeding reasonable levels, and maintaining the cost accounting discipline that separates what you choose to pay from what you can charge to federal contracts.

The Legal Framework Governing Executive Compensation Caps

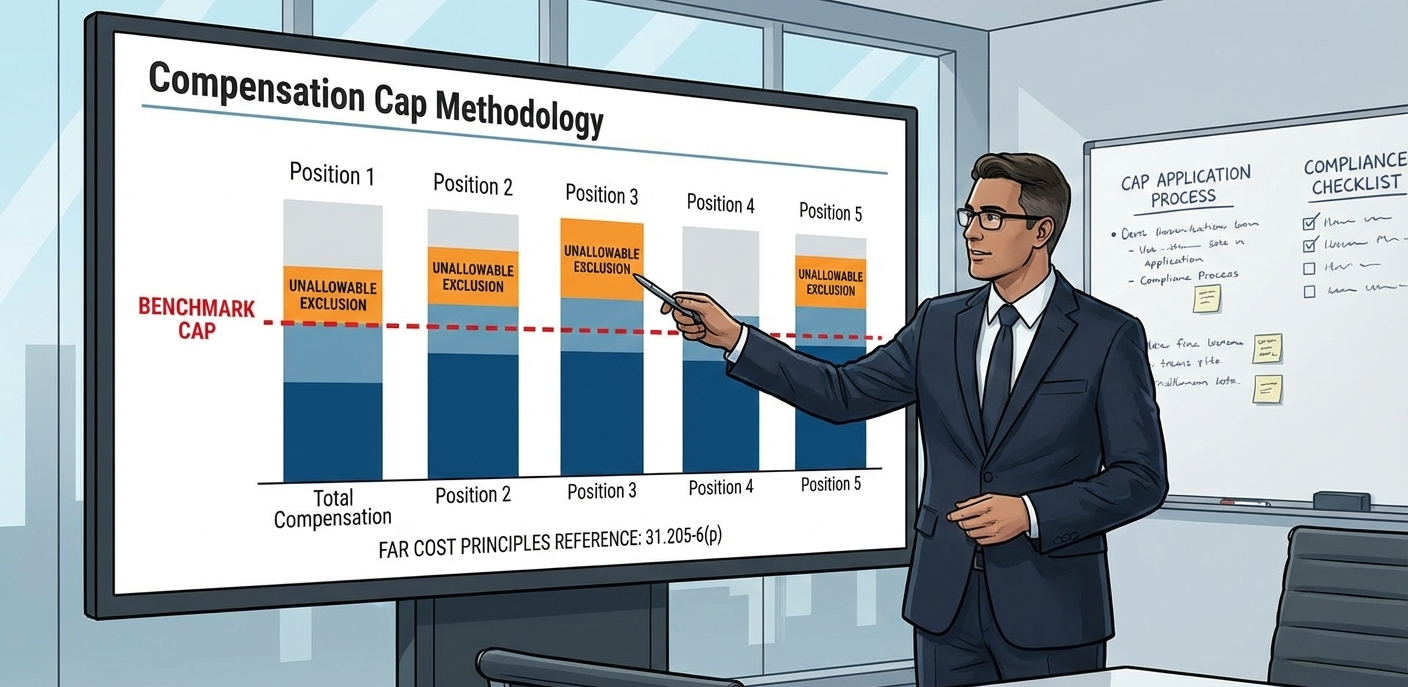

Federal cost principles establish specific limitations on executive compensation allowability ensuring government contracts don’t subsidize excessive pay regardless of what contractors actually compensate employees. FAR 31.205-6(p) establishes the executive compensation benchmark limitation, capping allowable compensation at the benchmark amount set annually by statute and published by the government. For contracts awarded on or after June 24, 2014, this benchmark applies to the five most highly compensated employees in contractor management positions, with compensation exceeding the benchmark treated as unallowable costs requiring exclusion from indirect rates and contract charging.

The benchmark calculation methodology under 10 USC 2324(e)(1)(P) establishes that allowable compensation cannot exceed the benchmark amount equal to the annual salary of the Vice President of the United States as of January 1 of the contract fiscal year. This statutory cap updates annually based on VP salary adjustments, with contractors required to monitor published benchmark amounts and apply appropriate year-specific caps when calculating unallowable excess compensation. Understanding DCAA compliance requirements means recognizing that compensation allowability depends on regulatory caps rather than market rates, with contractors bearing responsibility for cap compliance regardless of competitive compensation pressures or talent retention challenges.

The compensation definition under FAR 31.205-6(a) encompasses total compensation including wages, salaries, bonuses, deferred compensation, employer contributions to defined contribution pension plans, and other forms of remuneration paid for services rendered. This comprehensive definition means cap calculations must include all compensation forms—not just base salary—with total compensation compared to benchmark limits. When your CEO receives $400,000 salary plus $300,000 bonus plus $175,000 in deferred compensation, total compensation of $875,000 gets compared to benchmark cap with excess amounts treated as unallowable regardless of compensation form creating excess.

The critical consideration involves FAR 31.201-6, requiring contractors to account for unallowable costs in a manner enabling ready segregation and exclusion from costs charged to government contracts. This mandates establishing accounting procedures identifying executive compensation exceeding caps, segregating excess amounts in dedicated unallowable cost accounts, and excluding unallowable compensation from indirect rate calculations before allocating costs to contracts. Compliance requires proactive identification and exclusion rather than retroactive adjustment after DCAA discovers violations during audits.

What Contractors Must Understand About Executive Compensation Cap Challenges

Here’s what contractors miss about compensation caps: the limitation applies to total compensation from all sources across your entire organization, not just amounts charged to government contracts or paid by specific business units. DCAA compliance explained emphasizes that contractors must evaluate total compensation paid regardless of funding source, identify portions exceeding caps, and exclude excess amounts from all indirect pools allocating to government work including overhead, G&A, and fringe benefits where applicable. Your CEO’s $875,000 total compensation includes both amounts funded through government contract revenue and commercial revenue, with excess over cap treated as unallowable for government work regardless of funding source.

The five most highly-compensated determination challenge emerges when contractors must identify which employees qualify as highly-compensated requiring cap application. This is where audits go sideways—the cap applies to the five employees in management positions receiving highest total compensation, not necessarily the five highest-paid overall employees or five employees with executive titles. Your company might have highly-compensated sales executives or technical fellows earning more than titled executives, but cap applies only to management positions excluding individual contributors regardless of pay level. Proper identification requires analyzing compensation by employee, evaluating whether positions involve management responsibilities, and ranking management employees by total compensation to identify top five requiring cap application.

The total compensation calculation complexity surfaces when contractors must aggregate all compensation forms for cap comparison including deferred compensation that might vest years in future, employer pension contributions calculated actuarially, bonus accruals estimated before final determination, and non-cash benefits requiring valuation. Your CFO might receive restricted stock vesting over four years—do you include full grant value in current year or only vested portions? Does employer 401(k) match count toward cap? What about company-paid life insurance premiums? DCAA timekeeping requirements extend conceptually to compensation tracking requiring detailed records supporting total compensation calculations and demonstrating cap application accuracy.

The allocation base reduction requirement creates calculation complications when excess compensation must be removed from indirect pool costs AND from allocation bases when those bases include labor costs. Your overhead pool might total $2 million allocated using direct labor base of $8 million. When executive compensation excess of $388,000 requires exclusion, overhead pool reduces to $1,612,000 but allocation base might also reduce if it includes indirect labor compensation. Failure to adjust both numerator and denominator of rate calculations when applicable creates the mathematical errors producing incorrect rates that over-recover costs through improper base treatment.

The fringe benefit interaction appears when executive compensation excess affects both direct compensation caps and associated fringe benefit treatments. When your CEO’s $388,000 excess compensation is unallowable, the associated fringe benefits (FICA, unemployment insurance, 401(k) match, health insurance) on that excess amount are also unallowable requiring separate calculation and exclusion. This cascading effect means total unallowable costs exceed simple compensation excess, requiring systematic calculation of all unallowable cost elements affected by executive pay cap violations.

The contract applicability confusion creates compliance challenges when contractors must determine which contracts trigger cap application. The benchmark limitation applies to contracts awarded on or after June 24, 2014, with earlier contracts potentially subject to different or no caps depending on award dates. Mixed contract portfolios with varying award dates require tracking which contracts are subject to caps, though practical compliance often involves applying caps across all government work rather than attempting differentiated treatment by contract award date given allocation complexity.

The documentation inadequacy becomes apparent when contractors lack detailed records supporting cap calculations, highly-compensated employee identification, total compensation determinations, and excess amount exclusions. DCAA expects comprehensive documentation including compensation agreements, payroll records, deferred compensation plans, bonus calculations, fringe benefit details, and cap application workpapers demonstrating that unallowable cost identification and exclusion occurred systematically using appropriate methodology rather than approximate estimates or after-the-fact corrections.

Five Essential Steps for Executive Compensation Cap Compliance

Step 1: Establish Systematic Processes for Identifying Highly-Compensated Employees

Develop annual procedures identifying the five most highly-compensated employees in management positions requiring benchmark cap application. Create detailed position analysis evaluating which roles constitute management positions involving supervisory responsibilities, organizational leadership, or strategic decision-making authority qualifying for cap application versus individual contributor roles exempt from caps regardless of compensation levels. Document position classifications with written rationale supporting management versus non-management determinations.

Implement comprehensive compensation tracking aggregating all compensation forms for each employee including base salary, bonuses and incentive pay, deferred compensation (vested and unvested portions based on FAR interpretation), employer pension contributions, stock-based compensation, and other remuneration. Create detailed compensation schedules showing calculation components and totals for all employees potentially subject to caps, enabling clear identification of top five highly-compensated management employees requiring cap application.

Conduct annual highly-compensated employee determinations before fiscal year-end enabling proactive unallowable cost identification rather than retroactive discovery during incurred cost submission preparation or DCAA audits. Early identification enables implementing exclusion procedures throughout the year through payroll coding, general ledger classification, or periodic adjustments ensuring unallowable costs segregate systematically rather than requiring year-end reconstruction.

Step 2: Calculate Total Compensation Using Compliant Methodologies

Develop detailed total compensation calculation procedures documenting which compensation elements include in cap calculations, how to value non-cash compensation and deferred amounts, what time periods to use for various compensation types, and how to handle unusual situations like mid-year executive changes or compensation modifications. Written calculation procedures ensure consistency across years and personnel while supporting audit defense demonstrating systematic methodology application.

Apply current year benchmark caps published annually by the government, monitoring regulatory updates and adjusting cap amounts when benchmark changes occur. Maintain documentation showing benchmark amounts used for each fiscal year, publication sources for benchmark determinations, and verification that appropriate year-specific caps applied to compensation calculations. Benchmark tracking prevents the common error of applying outdated caps when benchmark amounts increase annually based on statutory adjustments.

Calculate unallowable excess compensation for each highly-compensated employee by comparing total compensation to applicable benchmark cap, with amounts exceeding cap representing unallowable costs requiring exclusion from indirect pools and contract charges. Develop detailed calculation workpapers showing total compensation, benchmark cap applied, excess amount calculated, and associated unallowable fringe benefits on excess compensation. Comprehensive calculation documentation supports both management review and audit verification.

Step 3: Implement Unallowable Cost Segregation and Exclusion Procedures

Establish dedicated general ledger accounts for unallowable executive compensation and associated fringe benefits, enabling clear cost segregation from allowable compensation included in indirect pools. Configure chart of accounts with specific unallowable compensation accounts by type (excess base salary, excess bonuses, excess deferred compensation, unallowable fringes on excess) providing detailed tracking supporting incurred cost submissions and audit verification.

Deploy systematic exclusion procedures removing unallowable executive compensation from indirect pool calculations before rate determinations, ensuring excess amounts never enter overhead, G&A, or other indirect pools allocating to government contracts. Implement controls preventing inadvertent inclusion of unallowable costs in rate calculations through automated account exclusion rules, manual review checklists, or periodic validation confirming rate calculations properly exclude all unallowable compensation amounts.

Adjust allocation bases when required to remove unallowable labor costs from bases including indirect labor compensation. When overhead rates allocate using direct labor base, evaluate whether indirect labor costs include executive compensation potentially requiring base adjustment when excess amounts are unallowable. Proper base treatment ensures rate calculations remain mathematically correct after unallowable cost exclusions, preventing the rate distortions that incomplete adjustments create.

Step 4: Maintain Comprehensive Supporting Documentation

Develop detailed documentation packages for each highly-compensated employee subject to caps including: position descriptions establishing management classification, employment agreements showing compensation terms, payroll records documenting actual payments, deferred compensation plan details, bonus calculation worksheets, fringe benefit summaries, and total compensation calculation workpapers. Organized documentation enables efficient management review and audit support while demonstrating systematic approach to cap compliance.

Create cap application audit trail documentation showing: benchmark amount determination with regulatory citations, highly-compensated employee identification with supporting analysis, total compensation calculations with component detail, excess amount computations comparing compensation to caps, and unallowable cost exclusion verification from indirect pool calculations. This audit trail demonstrates compliance rigor while enabling DCAA to verify cap application without extensive additional information requests.

Implement documentation retention ensuring compensation records, cap calculations, and supporting detail preserve for periods matching contract record retention requirements—typically six years after final contract payment. Comprehensive retention prevents the documentation gaps that create audit challenges when historical records cannot be produced supporting past compensation cap application and unallowable cost treatment.

Step 5: Conduct Periodic Compliance Review and Validation

Perform quarterly compensation monitoring tracking year-to-date compensation for employees potentially subject to caps, comparing accumulations to pro-rata benchmark amounts, and identifying potential excess amounts requiring unallowable cost treatment. Periodic monitoring enables early identification of cap issues allowing proactive management response including compensation adjustments, unallowable cost accruals, or other actions addressing excess amounts before year-end when options become limited.

Implement annual pre-submission reviews before incurred cost proposal preparation, validating that highly-compensated employee identification is current, total compensation calculations are complete and accurate, unallowable excess amounts are properly calculated, and exclusions from indirect pools occurred correctly. Pre-submission review catches calculation errors, methodology issues, or documentation gaps enabling correction before official submission to DCAA rather than discovering problems during audit.

Conduct management review of compensation cap compliance ensuring executives understand limitations on allowable compensation, approve methodology for cap application and excess cost treatment, and make informed decisions about compensation levels recognizing portions exceeding caps represent unallowable costs not recoverable through government contract pricing. Executive engagement demonstrates organizational commitment to compliance while enabling strategic compensation decisions informed by cap implications.

The Investment in Executive Compensation Cap Compliance

Implementing systematic executive compensation cap compliance costs between $6,000 and $20,000 annually for small to mid-sized contractors including highly-compensated employee identification, total compensation calculation, cap application, documentation preparation, and management review. These costs represent necessary compliance investments when employing executives whose compensation approaches or exceeds benchmark limits, with implementation preventing the substantial questioned costs that cap violations create.

Let me show you the value: contractors with proper cap compliance exclude unallowable executive compensation systematically preventing questioned costs from excess amounts improperly charged to government work, maintain accurate indirect rates reflecting only allowable costs supporting competitive pricing and cost recovery, and demonstrate cost accounting discipline that DCAA recognizes through efficient audits. They avoid the painful cost recoveries requiring contract billing adjustments when audits discover systematic cap violations spanning multiple years.

Contractors with inadequate cap compliance face substantial questioned costs when DCAA discovers executive compensation exceeding caps was charged to government contracts, experience indirect rate adjustments affecting all contracts when excess compensation removal requires rate recalculation, and suffer reputation damage when compensation cap violations suggest inadequate cost accounting systems or management oversight. They discover that failing to implement cap compliance costs far more than systematic compliance procedures through questioned costs, billing adjustments, and potential business system disapproval.

Understanding Executive Compensation Cap Scope and Applicability

Executive compensation caps apply to DoD contracts subject to FAR cost principles and specifically to contracts awarded on or after June 24, 2014 under provisions of 10 USC 2324. Civilian agency contracts follow similar limitations through agency-specific regulations, though specific applicability may vary by agency and contract award date. Contractors supporting multiple agencies must understand applicable caps for each customer, though practical compliance often involves applying most restrictive caps across all government work ensuring comprehensive compliance.

The benchmark limitation applies to cost-reimbursement contracts where compensation costs directly determine reimbursement and affects indirect rates used for all contract types including fixed-price contracts priced using cost data or requiring cost tracking. Small business contractors face identical caps as large contractors, with benchmark limitations applying regardless of contractor size, revenue, or business maturity.

Your Path to Executive Compensation Cap Compliance

The executive compensation cap landscape rewards contractors who implement systematic identification, calculation, and exclusion procedures ensuring unallowable excess compensation never enters indirect pools or contract charges. DCAA evaluates cap compliance through detailed compensation record review and rate calculation verification, with adequacy depending on documentation quality and methodology rigor rather than compensation levels.

For contractors seeking cap compliance support, Hour Timesheet provides labor tracking enabling the time-based allocation of executive effort when needed to support compensation calculations or cost classifications. Our systems provide documentation supporting various compensation compliance requirements.

Your executive compensation decisions can reflect market realities and business needs while cap compliance ensures government contracts only absorb compensation up to regulatory limits. Implement systematic procedures ensuring excess amounts receive proper unallowable treatment protecting cost recovery and compliance status.