Allocating Fringe Benefits: DCAA Best Practices for Compliance

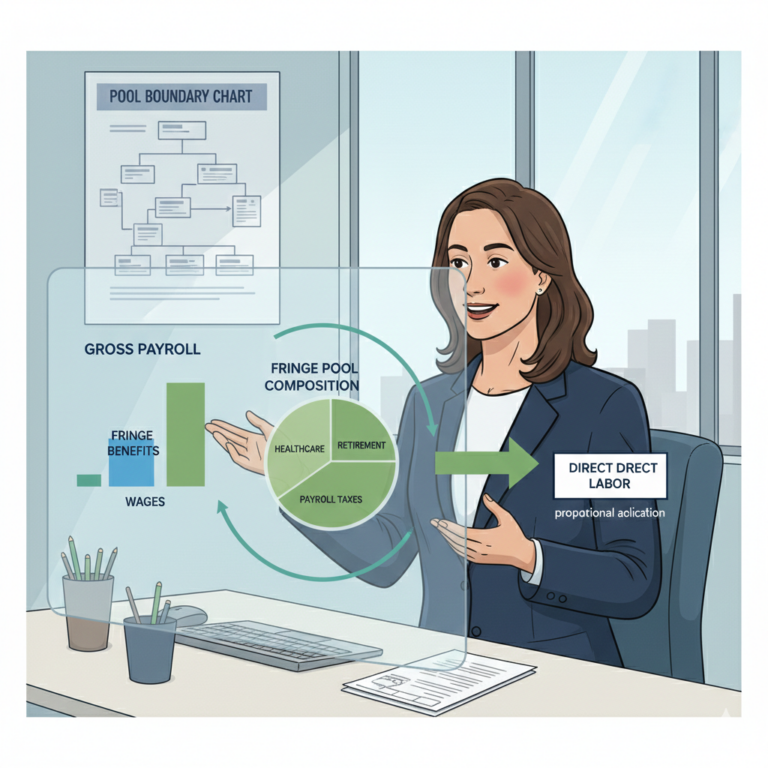

Your company calculated fringe benefit rates by dividing total fringe costs by total payroll including both direct and indirect labor, then applied those rates to direct labor only when charging contracts—effectively allocating indirect employee fringe costs to direct contracts while excluding them from overhead calculations. During your incurred cost audit, DCAA discovered this inconsistency and…